Our Added Value

Our banking consulting experts help you decide how to best optimize the experience you offer to your customers and employees, how to maintain your current IT infrastructure, and how you should leverage technology to gain market share and improve the bottom line.

With our value-driven approach, Levio ensures that your investments generate the expected returns and benefits.

Levio Knows Banking

How digital is impacting the banking sector

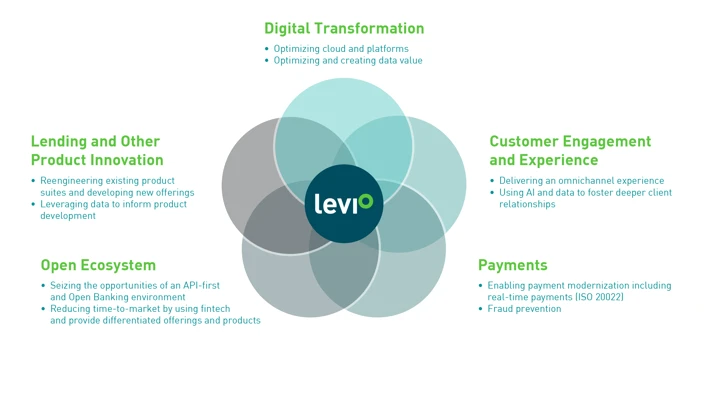

Considering our experience and understanding of major market trends, most banks face a combination of the challenges above. Not only do we help banks identify the right digital roadmap, but we also support them in implementation by covering the technological, business, and human aspects.

Our pillars

Advisory Services

Levio brings a comprehensive array of mission-critical management consulting advisory services to its clients in the areas of strategy, performance, digital and IT, and change management. Individually and collectively, our practices help our banking clients with the delivery of their investment agenda.

- Customer and employee journey mapping

- Business strategy

- Modernization road mapping

- Change management

- Benefits identification and realization

Functional Services

With experienced program and project management professionals, change management experts, and local and offshore capabilities, we can tackle your transformation initiatives and deliver the expected business results. Levio always delivers on scope, on budget and on time. Here are our services:

- Project management

- Design thinking experts that provide guidance

- Business process design

- Customer journey mapping

- Mergers and acquisition due diligence

- Expert staffing

Technical Services

Levio partners with you by adapting to your technical needs. We provide leading-edge expertise in:

- Cybersecurity and enterprise risk management

- Solutions architecture

- ERP implementation

- Evolution and maintenance

- Software engineering

- Cloud and infrastructure

- AI, data and analytics

Here are our services:

- Core system modernization

- API integration

- Microservices development

- Custom software and solutions development

- Cloud migration

- Cybersecurity, risk assessment, and testing services

- Payment infrastructure · Mobile application development

- AI, BI, ML, and massive data modernization